Bahamas News

Scores of Students Equipped with Supplies to Return to School

Bahamas News

Get your laugh on, March On, family drama by Gea Pierre, debut this weekend in Turks and Caicos

Bahamas News

The Bahamas Successfully Hosts Its Fourth World Athletics Relays

Bahamas News

PM at World Relays 2024 Opening: ‘Tonight, the eyes are on The Bahamas’

-

Health7 days ago

Health7 days agoAstraZeneca withdraws COVID vaccines after millions took their jabs

-

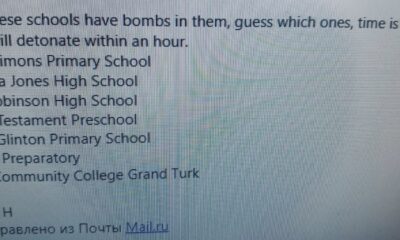

TCI News1 week ago

TCI News1 week agoBomb Threat No 6. In TEN days

-

Caribbean News4 days ago

Caribbean News4 days agoBelize, Jamaica and St. Vincent and the Grenadines eliminate mother-to-child transmission of HIV and Syphilis

-

TCI News3 days ago

TCI News3 days agoEquity in Energy says Bahamas Energy & Transport Minister in legislative roll out

-

TCI News3 days ago

TCI News3 days agoFamily of 16 tourist claims negligence in Grand Turk jet ski death; Coroner’s Court hearing evidence

-

world news5 days ago

world news5 days agoElectricity Access for 600 Million a goal of UN Sustainability Week

-

Caribbean News4 days ago

Caribbean News4 days agoMagnetic Media attends Caribbean Media Summit, in focus AI in Journalism

-

Bahamas News3 days ago

Bahamas News3 days agoThe Bahamas Successfully Hosts Its Fourth World Athletics Relays