NASSAU, The Bahamas – Prime Minister and Minister of Finance the Hon. Philip Davis said on July 15, 2024, that he spoke in support of the compendium of Bills to legalise the use of cannabis for medical and religious purposes, to decriminalise the possession of small amounts of cannabis, and to “regulate the cultivation, sale and use of cannabis and related products within our borders and to promote the health and safety of our people.”

“This has been a long time coming,” Prime Minister Davis said, during his Contribution to the Cannabis Reform Compendium 2024 Debate in the House of Assembly.

“For years, Bahamians have called for an administration to have the courage to step up and take this issue on in a decisive and responsible manner,” he added. “While many other countries, including nations within our region like Jamaica, Trinidad & Tobago, Antigua & Barbuda and Barbados, have taken steps toward decriminalisation and legalisation for medical use, Bahamians were left wondering when it would be our turn to modernise our local approach to cannabis.”

Prime Minister Davis noted that the national dialogue had been ongoing for the better part of a decade.

“Many people thought change was imminent when the Marijuana Commission began its work in October 2018, under the previous administration,” he said. “These efforts culminated in a preliminary report delivered in January 2020 and a final report delivered in August 2021.”

He added: “The Commission cited a wide range of in-person discussions and public opinion research, noting that there appeared to be widespread public support for the legalisation of cannabis for medical purposes. There was also healthy support for decriminalisation and an appetite for a strong regulatory and enforcement framework to ensure high standards for this new industry.”

Prime Minister Davis pointed out that the recommendations of the Commission called for legalisation for medical use, decriminalisation for small amounts, legalisation for use as a religious sacrament for members of the Rastafarian community, as well as strict regulations to ensure the quality and safety of the local cannabis product.

“In the PLP’s Blueprint for Change, we committed to developing a comprehensive regulatory framework for growing, harvesting, and exporting cannabis to create opportunities for Bahamians,” he said.

“The approach we developed to legislating and regulating Cannabis was informed by widespread research and consultation,” Prime Minister Davis added. “It was partially based on the CARICOM Regional Commission on Marijuana’s research and findings, as well as the approaches of other jurisdictions like Jamaica, Barbados, and Canada, where Cannabis has been legalised and regulated.”

He said that his Government’s goal was to ensure that it developed the most fair, balanced, and effective legislative and regulatory mechanisms, which would allow The Bahamas to reap economic and health benefits while promoting law and order and keeping its people safe through the introduction of stringent standards.

Prime Minister Davis added: “Once we felt that we had an adequate draft, we released the draft bills publicly, and we held a number of stakeholder consultation sessions, led by the Attorney General’s Office, in which we sat down with major stakeholder groups like healthcare providers, leaders of our church community, advocates for legalisation, leaders of the Rastafarian community – some of whom I see here today, as well as those who had concerns about the impact of legalisation and decriminalisation on the proliferation of usage. These varied opinions were taken into account and adjustments were made to achieve the most practical and effective approach that would work best for the Bahamian people.”

He pointed out that his Government also paid close attention to ongoing research on the issue – the most recent of which, he noted, was a survey conducted nationally by Public Domain in 2023, which indicated that 61% of the population supported the legalisation of cannabis for medical usage.

“It was clear that the times had changed, and it was time for our laws to change as well,” Prime Minister Davis stated.

He continued: “We’ve been hard at work since 2021. We knew this was not a process we could rush. There was a recognised need for carefulness and due diligence, but there was also a need to ensure that this new legislative and regulatory regime could be introduced and implemented within this term. We could not simply kick the can down the road for our next term the way other administrations did. No, we could not delay these changes – not when so many people had waited for years for real action to be taken.

“Today, the wait is over.”

Prime Minister Davis noted that his Government was taking action on behalf of all of the people who simply wanted the ability to legally consume medical cannabis to help them with their medical conditions.

“There are people with children suffering from epilepsy who have been praying for this moment,” he said. “There are people with glaucoma who want the opportunity to potentially alleviate their condition with a cost-effective and natural treatment.”

Prime Minister Davis added that there were people living with auto-immune conditions, chronic pain, anxiety, depression, and other ailments who were “waiting not-so-patiently for this day.”

“We are taking action for the many men and women living with criminal records for carrying small amounts of cannabis, and the many others who will be spared criminal records as a result of decriminalization,” he said.

others who will be spared criminal records as a result of decriminalization,” he said.

Prime Minister Davis stated that, as a society, his Government realised that the old approach taken against Cannabis in the War on Drugs in the 1980s and 90s did not necessarily reflect the current reality.

“Too many livelihoods have been lost because of a joint,” he said. “Too many lives have been handicapped and potentials lost.”

He added that when he was saying that, it was not his intent to excuse those who choose to break the law.

“After all, the law is the law; it must be respected and upheld,” Prime Minister Davis stated. “But we also recognise that the law is not static, it is dynamic. And the interpretation of the law and how it serves the greater good of society can change over time. I am confident that many lives will be changed for the better as a result of the criminal records that will be expunged.”

“Through these reforms, we are upholding the rule of law, making it clear that if you are seeking to supply others with cannabis illegally or engage in other unlicenced and illegal activities, you will be held accountable,” he added. “Everyone is welcome to participate within the legal and regulatory framework and only within that framework.

“Of course, as a part of this reform process, we are also taking action to recognise the rights and freedoms of Rastafarians to use Cannabis as a sacrament because it should not be against the law for our brothers and sisters of the Rastafarian faith to practice their religion.”

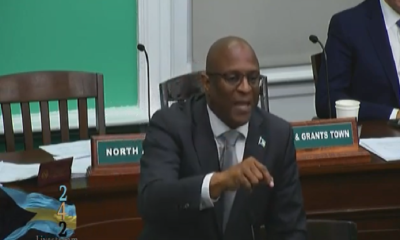

PHOTO CAPTION

Prime Minister and Minister of Finance the Hon. Philip Davis speaks, on July 15, 2024, during his Contribution to the Cannabis Reform Compendium 2024 Debate in the House of Assembly. (BIS Photos/Ulric Woodside)

Release: BIS

Caribbean News7 days ago

Caribbean News7 days ago

Caribbean News7 days ago

Caribbean News7 days ago

Caribbean News1 week ago

Caribbean News1 week ago

Caribbean News7 days ago

Caribbean News7 days ago

Bahamas News7 days ago

Bahamas News7 days ago

News7 days ago

News7 days ago

Bahamas News1 week ago

Bahamas News1 week ago

News7 days ago

News7 days ago