Turks and Caicos Islands, December 17, 2025 – Corporate partners in and around Providenciales recently joined Beaches Turks and Caicos Resort raising over US $54,000 to support Jamaica’s Hurricane Melissa Relief effort. The fundraising dinner, aptly titled, ‘One Caribbean, One Family, One Love’ saw over eighteen companies gather on Friday, December 12 to support the recovery of families and the rebuilding of communities affected by the category 5 storm.

Caicos Resort raising over US $54,000 to support Jamaica’s Hurricane Melissa Relief effort. The fundraising dinner, aptly titled, ‘One Caribbean, One Family, One Love’ saw over eighteen companies gather on Friday, December 12 to support the recovery of families and the rebuilding of communities affected by the category 5 storm.

“When our Caribbean family calls, we will respond with love,” said Deryk Meany, General Manager of the Beaches Turks and Caicos resort. “Today it is Jamaica that is affected, but tomorrow, it could be the Turks and Caicos or another neighbouring island. We are committed to serving our brothers and sisters and are deeply grateful to everyone who have donated to the cause.”

Since the passage of Hurricane Melissa in Jamaica on October 28, the Sandals Foundation has been working around the clock with local agencies and international partners to provide shelter essentials, food, and clean water, restore schools, and provide medical support to hospitals. Funds raised at the recent benefit dinner will help bolster the next phase of the philanthropic organisation’s support to rebuild schools and livelihoods in affected communities.

agencies and international partners to provide shelter essentials, food, and clean water, restore schools, and provide medical support to hospitals. Funds raised at the recent benefit dinner will help bolster the next phase of the philanthropic organisation’s support to rebuild schools and livelihoods in affected communities.

“As we continue to provide essential first-relief support, we have already begun our long-term recovery response,” says Patrice Gilpin, Public Relations Manager at Sandals Foundation. “Many schools, which are the cornerstone of stability, learning, and emotional support for our young ones, require urgent attention. This donation will go a far way in restoring a sense of normalcy in the lives of our youngest and most vulnerable.”

The One Caribbean, One Family, One Love fundraising dinner featured, amongst other things a silent auction of Sandals and Beaches Resort stays, airline tickets, spa services, catamaran cruise, and private chef dinner. The night’s four course meal was also spearheaded by the TCI’s 2025 Taste of the Caribbean silver medalist culinary team- all of whom volunteered for the event.

Resort stays, airline tickets, spa services, catamaran cruise, and private chef dinner. The night’s four course meal was also spearheaded by the TCI’s 2025 Taste of the Caribbean silver medalist culinary team- all of whom volunteered for the event.

Managing Director of the Northern Caribbean and Curaçao, James McAnally expressed delight at the outcome noting, “The success of this event is indicative of the power of partnerships to effect real change. We are grateful to the TCI business community, resort guests and our resort team for coming together and making this moment count.”

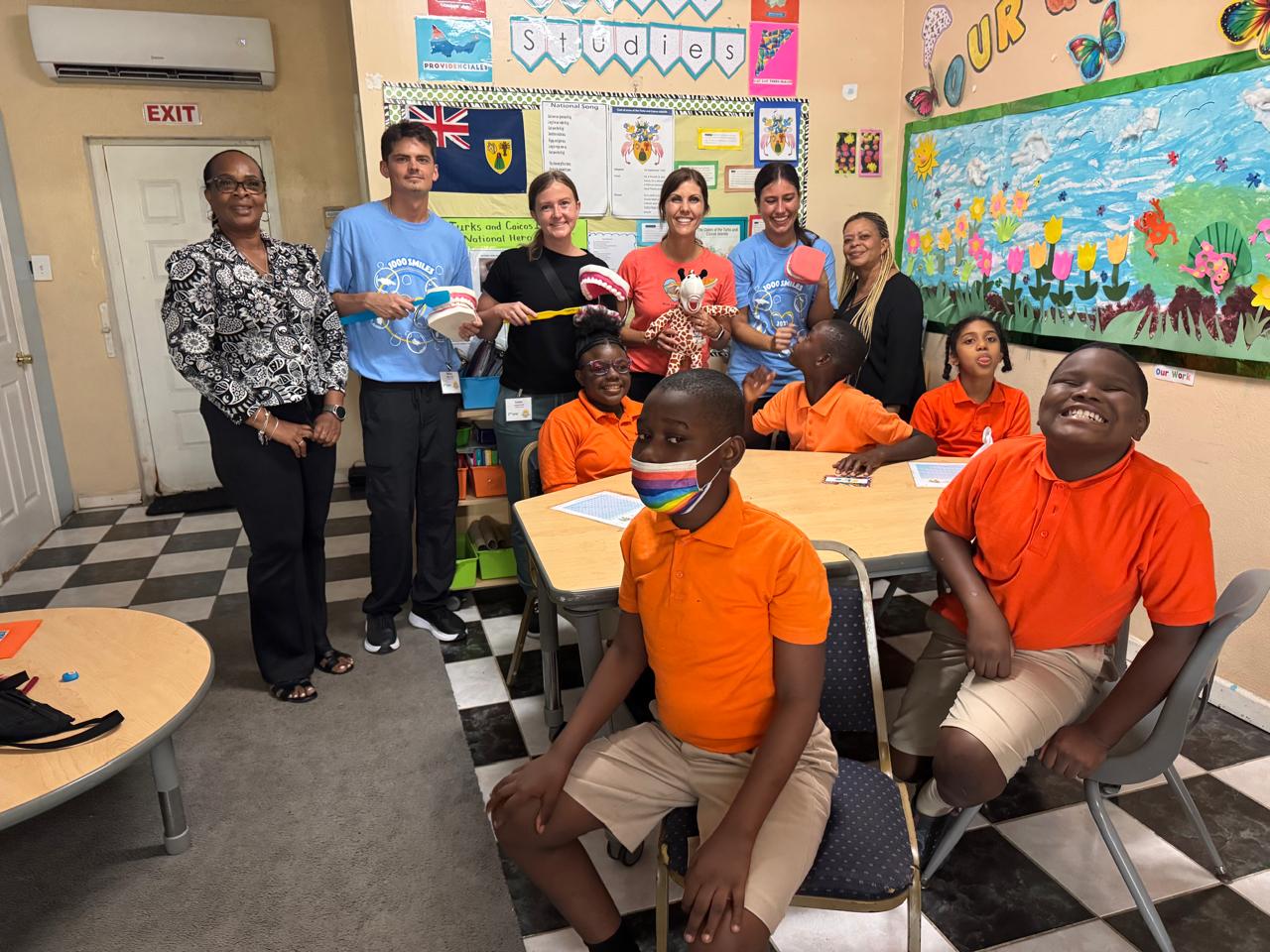

Photo Captions

1st insert: Sandals Foundation Public Relations Manager Patrice Gilpin (centre) accepts the cheque from Beaches Turks and Caicos resort General Manager Deryk Meany (left) and Managing Director of the Northern Caribbean and Curacao James McAnally

2nd insert: Members of the Beaches Turks and Caicos resort’s entertainment team were on hand to provide scintillating performances at the event

3rd insert: Beaches Turks and Caicos resort General Manager Deryk Meany (5th left) poses for the cameras with representatives of the Graceway Communities as he personally thanked those who were in attendance