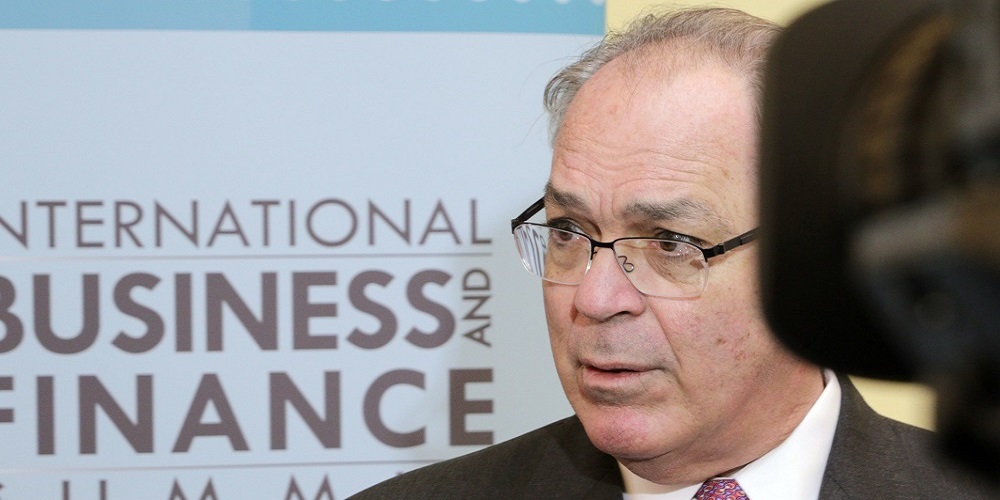

#Bahamas, March 5, 2018 – Nassau – Minister of Financial Services, Trade & Industry and Immigration, the Hon. Brent Symonette, says that steps are being taken to grow and sustain the financial services sector. The Minister delivered opening remarks during the 15th annual International Business and Finance Summit. The event was held at the Baha Mar Convention Centre on Thurday, 1st March under the theme, “Hit the Reset Button.”

“I assumed my role as Minister of Financial Services, Trade & Industry and Immigration nine months ago,” said Mr. Symonette. “And it is my mission to ensure that we engage industry, follow emerging trends and strategically position ourselves to be innovative as we move forward for the growth and sustainability of financial services in The Bahamas.”

“I assumed my role as Minister of Financial Services, Trade & Industry and Immigration nine months ago,” said Mr. Symonette. “And it is my mission to ensure that we engage industry, follow emerging trends and strategically position ourselves to be innovative as we move forward for the growth and sustainability of financial services in The Bahamas.”

He said that globally the Financial services industry is ‘constantly’ being threatened by increased global regulatory standards, unscrupulous persons wishing to use it for illicit or illegal activity, and technological changes that threaten human capital allocation. As a result, the government is enhancing systems and processes to comply with global regulatory standards, creating and amending legislation and enforcement actions to thwart against illicit or illegal activity, and sharpening human capital resources to adapt to technological advances.

“Our progress thus far has consisted of new legislation and legislative amendments that affect various industries including financial services, immigration, trade and commercial enterprise, as well as, the implementation of appropriate structural and macroeconomic policies which are being designed to improve economic efficiency and to create conditions conducive for integration into the world economy,” he said.

His portfolio as Minister of Financial Services, Trade & Industry and Immigration, contains three sectors that are interlinked. He said that Financial services can be as ‘innovative and creative’ as it wants to be, but if it is difficult for business persons and professionals to come here to facilitate this engine, then progress and development of financial services will be hindered.

“If trade and industry is not being constantly developed and new avenues for this to grow are not explored and implemented, trade in financial services and adjunct businesses that are created as a result, will have no room to thrive,” he said. “The reason I am highlighting these areas, is because they have long been impediments to our continued success in financial services. Today, I can say, we have gained some ground on removing these impediments.”

Some of the initiatives include the Ease of Doing Business policy, which includes improvement in the business licence process and advances in technology. Further, the government is also embarking on amending to legislation, from the Central Bank of The Bahamas, making the process around ‘Know Your Customer,’ and Money Laundering and Terrorist Financing less regimented to make it easier to open accounts and transact business.

“My Ministry is also engaged in discussions with the Governor of the Central Bank to relax exchange control, an issue which is of concern to many in the business community to access international finance across borders,” he said. “We believe that this relaxation will attract foreign direct investment and allow Bahamians and foreigners to move goods and products more freely and efficiently.”

The Securities Commission of The Bahamas is also making amendments to the Investment Funds Act. This Act, he noted, is out for consultation and will assist in enhancing this service. It is expected to be passed before the end of the year.

Another initiative is the Commercial Enterprise Act, of which the aim is to make it easier for persons investing in specialized areas such as arbitration, technology, call centres, international & maritime trade and captive insurance to obtain work permits more quickly and efficiently. The government is also facilitating various immigration reforms, namely adjustments in the application proces for short-term work permits for persons entering the Bahamas for the purpose of business for a period of less than 21 days.

Another initiative is the Commercial Enterprise Act, of which the aim is to make it easier for persons investing in specialized areas such as arbitration, technology, call centres, international & maritime trade and captive insurance to obtain work permits more quickly and efficiently. The government is also facilitating various immigration reforms, namely adjustments in the application proces for short-term work permits for persons entering the Bahamas for the purpose of business for a period of less than 21 days.

“We have also revised our policy on permanent residency on the purchase of a residence. With effect from 1st July, 2018, the threshold will be increased to $750,000 instead of the $500,000 threshold that has been in place for numerous years,” he said.

Other initiatives include Human Capital Development; signing onto the Common Reporting Standards (CRS) protocols and Expansion of Financial Services

“The Bahamas is known for its long history and knowledge in the wealth management space. In the next phase of our transformation, we must expand this space,” said Minister Symonette.” We are exploring the Asset Management, Global FX pricing and liquidity, and Fintech, just to name a few as expansions to our current offerings in financial services.”

By: Betty Vedrine (BIS)

Photo Captions:

Header & First insert: Minister of Financial Services, Trade & Industry and Immigration, the Hon. Brent Symonette delivering opening remarks and answering questions during the 15th Annual International Business and Finance Summit. The event was held at the Baha Mar Convention Centre on Thurday, 1st March under the theme, “Hit the Reset Button.”

Second insert: Minister of Financial Services, Trade & Industry and Immigration, Hon. Brent Symonette chatting with Former Minister of Financial Services Minister, Ryan Pinder during the 15thAnnual International Business and Finance Summit. The event was held at the Baha Mar Convention Centre on Thurday, 1st March under the theme, “Hit the Reset Button.”

(BIS Photos/Derek Smith)