#Kingston, Jamaica – June 19, 2024 – Lasco Financial Services, a leading provider of financial products, including their LASCO GOLD Visa prepaid card, proudly announces its strategic partnership with FirstCare Medical Plan. This collaboration aims to expand access to financial services and affordable healthcare for individuals and small and medium enterprises (SMEs) across Jamaica.

As part of this groundbreaking partnership, cash-based customers can now load their LASCO GOLD Visa card to pay for their FirstCare membership online, further broadening the healthcare plan’s accessibility. This partnership allows Lasco’s clients to use their cards to pay for their healthcare plan as well as provide another payment option for FirstCare members.

“We are excited about this partnership as it opens new avenues for financial inclusion and healthcare accessibility,” stated Jacinth Hall-Tracey, Lasco Financial Services Managing Director. “Our goal is to empower cash-based and underserved communities by providing them with the tools they need to lead healthier, more financially secure lives.”

Cash-based customers can use the Lasco prepaid card to pay for their FirstCare membership online, significantly broadening the accessibility of this essential healthcare plan. Additionally, LASCO Microfinance Ltd, with its nine branch locations island-wide, provides financing up to $2.5 million for personal loans and up to $10 million for business loans, supporting SMEs in their growth and development.

Addressing the partnership, Jheanell Thompson, FirstCare Country Manager, highlighted the company’s dedication to creating sustainable healthcare solutions.

“At FirstCare, we believe in the power of partnership to transform our community’s health. Our strategic alliance with Lasco is designed to expand affordable primary healthcare access to all. This initiative will empower individuals and small and medium-sized corporate groups to maintain their health without sacrificing their bottom line, reinforcing our commitment to helping build healthier, more productive individuals and teams.”

designed to expand affordable primary healthcare access to all. This initiative will empower individuals and small and medium-sized corporate groups to maintain their health without sacrificing their bottom line, reinforcing our commitment to helping build healthier, more productive individuals and teams.”

Meeting the Healthcare Needs of Jamaica

Today, many individuals and small business owners are struggling to afford comprehensive medical care. FirstCare addresses this gap by providing free doctor visits and significant discounts on specialist services, labs, imaging, optical, pharmacy, and dental services. The plan’s vast network includes more than 300 medical providers, with over 100 General Practitioners spanning ten parishes, ensuring quality healthcare is accessible to all Jamaicans.

“Recognizing the critical gaps in healthcare accessibility in Jamaica, together with Lasco Financial, we aim to bridge these gaps,” shared Thompson. “SMEs often struggle to provide comprehensive healthcare benefits to their employees due to the high cost of healthcare services. Our collaboration marks a significant step forward in ensuring that business owners and their employees can thrive professionally and enjoy healthier lives with access to essential medical services.”

Key Benefits of FirstCare:

- No Cost Primary Care Visits: Free unlimited visits to more than 100 in-network general practitioners, plus discounted ambulance services and 24-hour urgent care.

- Discounted Labs & Imaging: Up to 15% savings at in-network labs and imaging centers.

- Specialist Doctors: Discounts at more than 100 in-network specialists across major cities.

- Optical Benefits: Save up to 40% and enjoy a free eye exam at over 20 locations.

- Pharmacy Savings: Instant savings of up to 15% at participating pharmacies.

- Dental Services: Save up to 20% on dental services.

- Lifestyle Rewards: Discounts at spas, restaurants, hotels, and more, which enhance overall well-being and lifestyle enjoyment.

Enhanced Financial Solutions for SMEs

Lasco Microfinance Ltd (LASMF), a subsidiary of Lasco Financial Services Ltd., will now offer FirstCare Medical Plan as an added benefit to their loan packages.

SMEs who secure loans from LASMF will also receive healthcare coverage through FirstCare Medical Plan, ensuring that essential healthcare services are more accessible. This initiative helps ensure that business owners and their employees can prioritize their health while focusing on growth and development.

FirstCare is at the forefront of digital innovation in healthcare, making it effortless for individuals to sign up and manage their health plans entirely online. Customers can easily enroll in the FirstCare plan from their smartphone or any device with internet access in under five minutes using their Lasco prepaid card and begin using their benefits immediately within the local network.

This streamlined, digital-first approach not only enhances accessibility but also empowers all Jamaicans to take proactive steps toward maintaining their health efficiently and affordably. Once enrolled, members can present their FirstCare membership card at any of the over 200 medical providers in the network to access their benefits.

For more information, visit FirstCare Jamaica and Lasco Microfinance.

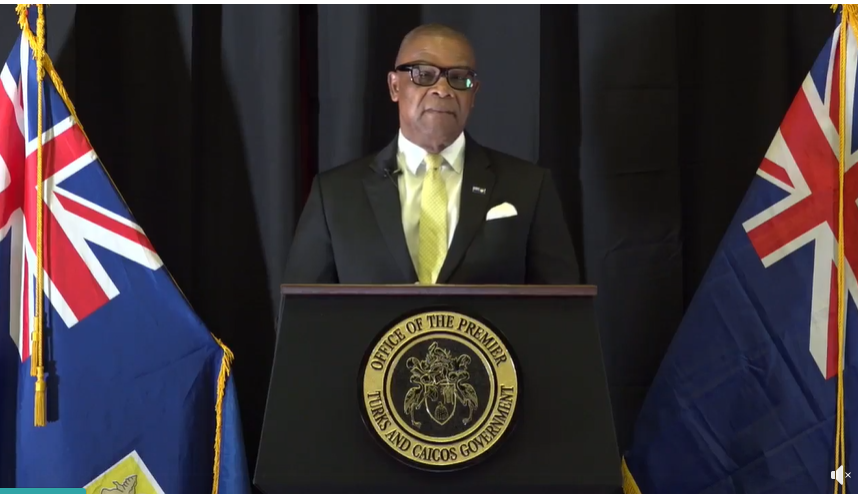

Photo Caption:

Strategic Partnership Announced to Provide Enhanced Healthcare Benefits: Jheanell Thompson, FirstCare Country Manager (left), and Jacinth Hall-Tracey, Lasco Financial Services Managing Director (right), sign partnership agreement, marking a new era of healthcare accessibility and financial empowerment for individuals and SMEs across Jamaica.

Caribbean News1 week ago

Caribbean News1 week ago

Caribbean News7 days ago

Caribbean News7 days ago

Caribbean News1 week ago

Caribbean News1 week ago

Caribbean News1 week ago

Caribbean News1 week ago

Bahamas News7 days ago

Bahamas News7 days ago

News7 days ago

News7 days ago

Bahamas News1 week ago

Bahamas News1 week ago

News7 days ago

News7 days ago