Finance

TCI Finance Minister tables new bill to TIGHTEN DUE DILLIGENCE

Finance

SCOTIABANK TURKS & CAICOS SECURES 4TH WIN AS BEST BANK

Caribbean News

RBC appoints new Head of Caribbean Banking

Finance

Largest ever Nat’l Budget to end on $436 million

-

Crime5 days ago

Crime5 days agoUnlocking Perspectives: Serious Tourist Incidents unveiled in TCI

-

TCI News5 days ago

TCI News5 days agoRegional SDGs Update; 22% to be reached by 2030

-

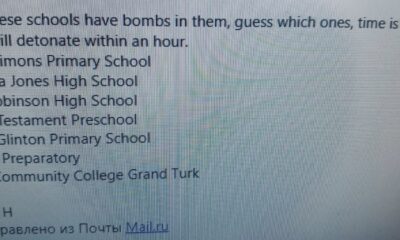

TCI News1 day ago

TCI News1 day agoBomb Threat No 6. In TEN days

-

Caribbean News4 days ago

Caribbean News4 days agoVISITOR ARRIVALS NOT NEGATIVELY AFFECTED BY TRAVEL ADVISORIES KINGSTON, May 1 (JIS):

-

Bahamas News4 days ago

Bahamas News4 days agoRBC appoints new Country Manager and Area Vice President for Turks & Caicos

-

Bahamas News5 days ago

Bahamas News5 days agoCIBC Caribbean announces the closure of Bay Street Branch

-

Bahamas News4 days ago

Bahamas News4 days agoBahamas economic growth

-

News5 days ago

News5 days agoFamily of 16 yo Tourist claims negligence in jet ski death; TCI Coroner’s Court hearing evidence