Finance

PNP Administration Announces $424.3 MILLION National Budget

Finance

SCOTIABANK TURKS & CAICOS SECURES 4TH WIN AS BEST BANK

Caribbean News

RBC appoints new Head of Caribbean Banking

Finance

Largest ever Nat’l Budget to end on $436 million

-

Latin America and Caribbean1 week ago

Latin America and Caribbean1 week agoRegional SDGs Update

-

Crime1 week ago

Crime1 week agoFollowing Court ruling, US Embassy Doubles Down on Warning: DO NOT TRAVEL TO TCI WITH GUNS, AMMO

-

Bahamas News1 week ago

Bahamas News1 week agoEnvironment State-Minister updates ‘Our Ocean’ forum on The Bahamas as SIDS leader in sustainable tourism

-

Bahamas News7 days ago

Bahamas News7 days agoPacesetting Cohort of Eleuthera Residents Graduate from Leading Light Programme

-

Bahamas News1 week ago

Bahamas News1 week agoNassau Cruise Port Donates Nearly $2 Million Towards Food Security

-

Caribbean News1 week ago

Caribbean News1 week agoRBC appoints new Head of Caribbean Banking

-

News1 week ago

“Mad Max” Convicted of Murder

-

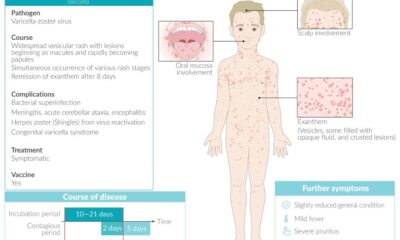

Health6 days ago

Health6 days agoIncreased cases of Chicken Pox Prompts Ministry of Health and Human Services Response