News

National Insurance Board Contribution and Benefit Regulations Legislative Amendments

Published

4 years agoon

#TurksandCaicos, April 4, 2022 – The main purpose of the Turks and Caicos Islands National Insurance Programme is to provide relevant social insurance protection through a wide range of benefits to the peoples of these islands, primarily our contributors and their dependents. To fulfil our mission, decision makers must seek to ensure the Fund remains viable into perpetuity.

Section 45(1) of the National Insurance Ordinance provides for the National Insurance Fund to be actuarially assessed every 3 years. As part of the review, the income and expenditure levels of the National Insurance Board are examined, including the current benefit and contribution rate structures; all towards safeguarding the future viability of the Fund.

Having conducted its 9th Actuarial Review in July 2019, among the main findings and recommendations, the Report observed that the Turks and Caicos Islands National Insurance Board’s current contribution rates have remained unchanged from inception in April 1992 (second lowest in the region). At the same time, there were numerous increases across all branches of benefits over the 3 decades.

- Contribution Rate Increase

The report indicated that based on the current design, structure, and parameters, the TCINIB is projected to be financially sustainable for the medium to long term and is forecast to have sufficient reserves to support the current estimated expenditure for another 27 years. Contribution Income is projected to cover all expenses until the year 2027, based on the current benefit provisions and current contribution rate of 8.0%.

After 2027, the NIS will have to use some of its investment income, in addition to its contribution income to cover the projected expenses. This will slow the rate of the growth of the reserves.

In order to protect its reserves, which are specifically set aside as a buffer to the system to provide for the continuous payment of future benefits during periods of economic downturn, the Actuary concluded and recommended that it is necessary to immediately increase the existing contribution rate structure.

Accordingly, all Employers, Employees and Self -Employed persons are hereby advised that Cabinet in accordance with the recommendations of the Actuary, has accepted and approved the implementation of incremental increases in the current contribution rates over the next three years with effect from April 1, 2022, as follows:

| April 1, 2022 | April 1, 2023 | April 1, 2024 | |

| Private Sector

Employer/ Employee: |

10% | 11% | 12% |

| 5.5% / 4.5% | 6% / 5% | 6.5%/ 5.5% | |

| Public Sector | 9.15% | 10.15% | 11.15% |

| Employer/Employee: | 5.075%/4.075% | 5.575%/4.575% | 6.075% /5.075% |

| Self-Employed | 8% | 9% | 10% |

While these are challenging times economically, the difficult decision was made to increase rates as recommended by the Actuary, to safeguard the Fund in the best interest of the people who have come to rely on the safety net it provides.

It is projected that NIS costs will escalate, primarily due to the Long-Term Benefits (LTBs) Branch. This is the branch from which Funeral Grants, Retirement, Invalidity, Survivors,’ and Non-Contributory Old Age Pensions are paid. That branch currently accounts for 78% of all costs and is projected to increase to 93% of all costs. As the NIS matures, more persons will be covered and will accumulate a greater number of contribution weeks, which enables them to qualify for a pension instead of a grant and to qualify for a greater average benefit amount. The rate increase will allow for the allocation of additional funds to the long-term branch of the Fund.

The decision to increase the rate at this time is a thoroughly considered decision. It was not taken lightly. If the NIB is to continue to provide benefits that are relevant, the Fund must remain strong. The fund can only remain strong with the right level of inflows to cover the expenses of the Fund.

Management continues to closely monitor and contain cost. Also, contribution collection compliance is always a key aspect of the operations, as we strive to collect all the funds due to the NIB. Thirty years later, the two alone are no longer sufficient to sustain the Fund. For the first time, the contribution rate must be increased to secure the longevity of the Fund.

Again, the new contribution rates are effective April 1, 2022, and will increase a further 1% over the next two years. There has been no change to the maximum ceiling of $4,000 per month.

Further, there are changes to the following National Insurance (Benefits) Regulations:

- Retirement Pension after age 65

In many social security circles, it is becoming more prevalent to increase the normal retirement age considering the increase in life expectancy. The National Insurance Board is not increasing its retirement age but is offering an incentive to insured persons who choose to delay accessing their pension after age 65.

Accordingly, effective April 1, 2022, an insured person who retires from insurable employment after the age of sixty-five, and who was not in receipt of a Retirement Pension prior to the age of sixty-five, shall be entitled to an increase in their Retirement Pension a half percent (½%) per month for every month, up to a maximum of 30% that their pension is delayed, commencing from the date of their retirement.

- Retirement Benefit Accrual Rate

The new accrual rate for the Retirement Pension benefit will be amended as follows for persons ages 49 years and under on April 1, 2022:

Twenty percent of the average weekly insurable earnings will be payable to an insured person who has paid or to whom has been credited not less than five hundred contributions.

This will be supplemented by a further 2% of the average weekly insurable earnings for each unit of fifty paid or credited contributions in excess of the first five hundred, up to a total of one thousand such contributions; or contribution years 11 to 20.

An additional 1% of the average weekly insurable earnings for each unit of fifty paid or credited contributions exceeding one thousand will be paid up to a maximum of 60%.

The qualifying conditions for the Retirement Pension for persons ages 50 years or more on the date the amendment is adopted will remain unchanged and they will receive a pension based on the current benefit formula.

- Amendment to Invalidity Pension

The minimum contribution weeks to qualify for an Invalidity Pension will increase from 150 to 300 contributions, effective April 1, 2022.

- Increase in Non-Contributory Old Age Pension (NCOAP) Age

The pensionable age for the NCOAP benefit will increase from sixty-eight to seventy, effective April 1, 2022.

Please feel free to contact us at 946-1048 (Grand Turk) or 941-5806 (Providenciales) for further details. You are also invited to visit our website at www.tcinib.tc or our Facebook page to see detailed information on the recent legislative changes.

You may like

-

NIB Needs Innovative Sustainable Strategies That Go Beyond Traditional Methods

-

NIB and NHIB now joined

-

Final NIB Increase Instituted on April 1 for TCI Workforce

-

Reactions varied to $18 Million Pay and Grading increase

-

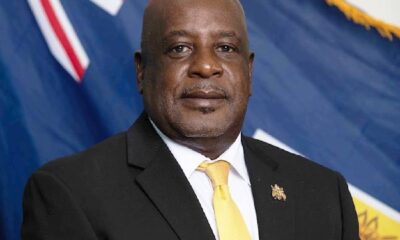

Cartwright gets nod for three more years at NIB helm; report on September 5 Cabinet Meeting

-

Bill to MERGE aspects of NIB and NHIP tabled, No Mixing of Money

News

Commonsense, Not Confrontation: Why Kamla Persad-Bissessar Is Right

Published

1 month agoon

December 27, 2025

This debate did not start with Donald Trump, and it did not start this month.

For more than a decade, this reporter has had a front-row seat to repeated, urgent calls from across the Caribbean for stronger intervention by the United States in response to gun- and narcotics-fuelled violence that has hollowed out our communities. Long before today’s headlines, leaders warned that transnational gangs were outgunning police, draining public resources and stealing our youngest people.

Much of the public messaging leaned toward calls for fewer guns flowing from the United States, but the practical response from Washington evolved into something else: tactical undergirding of the Caribbean. Training, intelligence sharing, maritime surveillance and joint operations expanded under successive U.S. administrations — Republican and Democrat alike.

Then came Venezuela.

President Nicolás Maduro proved himself an unhinged and destabilising force, openly threatening Guyana’s oil-rich territory and pushing the region to the brink of a conflict no Caribbean state could afford. The United States showed up. The threat of war was blunted. That mattered.

But while geopolitical flames were contained, the narcotics trade exploded.

CARICOM convened emergency meetings on transnational gang violence. Crime became so pervasive that it was formally classified as a public health threat. Entire communities were terrorised. Courts clogged. Police forces stretched beyond capacity.

And now — quietly but noticeably — the tempo has shifted.

While no single forensic study can capture the full picture, it is easily verifiable on the ground that major narcotics busts and trafficking activity have slowed in recent months. Something has changed. Pressure works.

This is the reality Prime Minister Kamla Persad-Bissessar is responding to.

Her critics accuse her of breaking ranks. What she is actually doing is refusing to indulge in strategic hypocrisy — demanding international help to confront narco-terrorism while appearing to defend or excuse the very networks and actors we have spent years condemning.

Sovereignty is not an insult. The Caribbean invokes it constantly. To deny it to the United States — especially when the policies in question were telegraphed months in advance and remain adjustable — is not diplomacy. It is posturing.

What is most troubling is the region’s selective memory. CARICOM has directed months of rhetorical fire at Trump-era policies, yet when disaster struck — from security crises to Hurricane Melissa — the United States remained one of the region’s most reliable supporters. Outcomes matter more than allegiance theatre.

Kamla Persad-Bissessar is not suffering from Trump Derangement Syndrome. She is applying commonsense statecraft. She understands that small states do not gain leverage by moral outrage alone, and that credibility is lost when we appear aligned with individuals, regimes or activities we ourselves have deemed a threat.

Her warning to CARICOM is simple and necessary: do not undermine your own cause.

The Caribbean’s fight against narco-violence, corruption and instability has been long, costly and painful. If pressure is finally producing results, we should be wise enough to recognise it — and brave enough to say so.

Angle by Deandrea Hamilton. Built with ChatGPT (AI). Magnetic Media — CAPTURING LIFE.

News

Beaches Turks and Caicos Showcases and Supports Local Creativity

Published

5 months agoon

September 12, 2025

September 12, 2025

PROVIDENCIALES, Turks & Caicos Islands – The Turks and Caicos Islands are home to a wealth of creativity, from artisans and craft vendors to musicians and performers. Beaches Turks and Caicos, the Caribbean’s leading all-inclusive family resort, has pledged its continued support for these individuals by providing meaningful platforms for them to share their skills and stories with guests from around the world.

The resort’s commitment is most evident in its weekly Cultural Night showcase, where visitors are immersed in the vibrant traditions of the islands. Guests enjoy live performances which feature local music genres such as ripsaw, while artisans display and sell handmade creations. This event not only enriches the guest experience but also strengthens economic opportunities for local entrepreneurs.

Entertainment Division Manager Garett Bailey emphasized the significance of Cultural Night, “we want to showcase everything the Turks and Caicos Islands culture has to offer. Our goal is for guests to leave with a deeper appreciation of the island’s art, music and traditions, while giving local talent the opportunity to share their creativity with visitors from across the globe.”

Beyond Cultural Night, Beaches Turks and Caicos also welcomes local craft vendors onto the resort every Wednesday and Friday where they are offered a direct space to market their goods. Guests have easy access to the Turks and Caicos Cultural Marketplace, where they can purchase authentic local arts and crafts.

where they are offered a direct space to market their goods. Guests have easy access to the Turks and Caicos Cultural Marketplace, where they can purchase authentic local arts and crafts.

Managing Director, James McAnally, highlighted how these initiatives reflect the resort’s broader mission, “we are committed to celebrating and sharing the vibrant culture of these islands with our guests. By showcasing local artistry and music, we not only provide entertainment but also help sustain and grow the creative industries of the Turks and Caicos Islands. From our cultural showcases to nightly live music, we are proud to create authentic connections between our guests and the people of these islands.”

Local musician Keon Hall, who frequently performs at the resort, expressed gratitude for the ongoing partnership, “being able to share my music with Beaches’ guests has created lasting relationships. Some visitors return year after year and request songs from previous performances. This partnership continues to celebrate what we do and strengthens the bond between local artists and the resort.”

The resort’s support of local artisans and entertainers extends beyond business opportunity; it is about preserving heritage and sharing stories. Guests take home more than souvenirs; they leave with experiences that deepen their understanding of Turks and Caicos’ culture and history.

Public Relations Manager, Orville Morgan, noted the importance of this commitment, “for many visitors, these interactions represent their first genuine connection to the Turks and Caicos Islands. From artisans and musicians to farmers and transport operators, our local talent helps shape every guest experience. At Beaches, we are proud to give them the stage to share their stories and their heritage.”

Beaches Turks & Caicos remains dedicated to developing cultural connections and supporting the artisans, musicians and entrepreneurs whose creativity makes the Turks and Caicos Islands unique. Each guest experience is an opportunity to celebrate and sustain the spirit of the islands.

Caribbean News

“Barbecue” is Cooked! US Turns Over 11 Million Haitians into Potential Informants with $5 Million Bounty

Published

6 months agoon

August 12, 2025

August 12, 2025

The United States just set fire to the underworld in Haiti — and this time, the smoke might finally flush out the man many call the most feared in the Caribbean.

On Tuesday, the U.S. government slapped a $5 million bounty on the head of Jimmy “Barbecue” Chérizier, the ex-police officer turned gang boss accused of orchestrating massacres, torching neighborhoods, and strangling Haiti’s capital into chaos. This isn’t just a headline — it’s a full-blown game-changer.

turned gang boss accused of orchestrating massacres, torching neighborhoods, and strangling Haiti’s capital into chaos. This isn’t just a headline — it’s a full-blown game-changer.

That kind of cash — offered under the State Department’s Transnational Organized Crime Rewards Program — is enough to turn the country’s entire population, more than 11 million people, into potential informants overnight. Add the millions in the Haitian diaspora, and Chérizier isn’t just wanted. He’s surrounded.

The Number That Changes Everything

Five million U.S. dollars today equals about 655 million Haitian Gourdes. In a country where many scrape by on less than $5 a day, that’s not just life-changing — it’s life-defining. It’s enough to rebuild homes, put generations through school, or buy a one-way ticket far from the gunfire.

In a place where trust is scarce and survival is everything, that figure is more than tempting — it’s irresistible. For Chérizier, it means every friend could be a future informant, and every loyalist might be calculating the cost of staying loyal.

‘We Will Find Them’ — Jeanine Pirro, U.S. Attorney

Jeanine “Judge Jeanine” Pirro, the U.S. Attorney, set the tone with fire in her voice. “This indictment is the first of its kind,” she announced. “Jimmy Chérizier, also known as ‘Barbecue,’ is a notorious gang leader from Haiti who has orchestrated and committed various acts of violence against Haitians, including the 2018 La Saline attack in which approximately 71 people were killed. He both planned and participated in that massacre.

“Anyone who is giving money to ‘Barbecue’ cannot say, ‘I didn’t know.’ They will be prosecuted, and we will find them. They are supporting an individual who is committing human rights abuses, and we will not look the other way.”

Pirro wasn’t just going after Chérizier. She was sending a warning to the Haitian diaspora accused of feeding his war chest from abroad: the days of claiming ignorance are over.

‘No Safe Haven’ — Darren Cox, FBI

Then came Darren Cox, Deputy Assistant Director of the FBI, delivering the muscle of America’s most powerful investigative force. “There is no safe haven for Chérizier and his network,” Cox declared. “We are closing every link, every cell.” Since January, he said, the FBI has arrested three Top Ten fugitives, taken more than 19,000 criminals off the streets, and seized thousands of tons of narcotics — enough to save millions of lives across the U.S.

The FBI’s Miami and Houston offices have already bagged one of Chérizier’s Viv Ansanm associates inside the United States without firing a shot. “These efforts are a deliberate and coordinated plan,” Cox said, “to protect our communities and confront escalating threats from terrorist organizations like Viv Ansanm.”

‘Three-Year Investigation’ — Ivan Arvelo, HSI

Ivan Arvelo, Assistant Director of Homeland Security Investigations, brought the receipts. “This is the result of a three-year investigation into Chérizier’s procurement networks, cash pipelines, and operational financing that violates sanctions,” he explained. Arvelo described 400 structures destroyed, entire communities erased, and a gang exploiting U.S. dollars, technology, and immigration loopholes to keep its killing machine running. “We tracked how Americans unwittingly bankrolled brutality,” he said — proof that the net is tightening both inside Haiti and abroad.

‘The Worst of the Worst’ — Chris Lambert, State Department

Chris Lambert, representing the State Department’s International Affairs division, gave the political bottom line.

“Mass violence in Haiti must end,” Lambert said. “The instability resulting from Chérizier’s actions fuels illegal migration, regional instability, and transnational crime. We will continue to apply every tool available — including our rewards programs — to stop the spread of unchecked violence, especially to target the worst of the worst criminal leaders threatening the people of our hemisphere.”

instability, and transnational crime. We will continue to apply every tool available — including our rewards programs — to stop the spread of unchecked violence, especially to target the worst of the worst criminal leaders threatening the people of our hemisphere.”

Lambert confirmed what many have long known: Chérizier is not just a gang leader. He commands Viv Ansanm, officially designated in May as a Foreign Terrorist Organization. In the eyes of the U.S., that makes him not just Haiti’s problem — but everyone’s.

Why Haitians May Not Resist

In Haiti, money talks — loudly. And when you put 655 million Gourdes on the table, it shouts.

That’s the kind of figure that turns casual acquaintances into informants and makes even the most hardened loyalist wonder if the payout is worth more than the risk. It’s not a matter of “if” word gets out, it’s a matter of “who will be first to collect.”

For grieving families, it’s a chance at justice. For the desperate, it’s a chance at survival. For Haiti as a whole, it’s hope — wrapped in the most dangerous of temptations.

An Answer to Prayers

For years, Haiti’s headlines have been a scroll of horrors — kidnappings, executions, burned neighborhoods, bodies in the streets. Chérizier’s name has been attached to too many of them.

This move by the U.S. isn’t just strategy. It’s personal. It’s a signal to every Haitian — at home or abroad — that the days of impunity could be ending.

I’ll admit it: when I heard the news, I danced, I sang, and I nearly cried. Not because $5 million is a lot of money, but because of what it means — the possibility, at last, of stopping the man accused of helping turn Haiti into hell on earth.

Four officials, four angles, one mission: Pirro’s fire, Cox’s grit, Arvelo’s precision, Lambert’s conviction. Together, they’ve put the heat on “Barbecue” like never before.

BBQ is cooked. The only question now is: which one of over 11 million potential informants will serve him up?