Caribbean News

Central Bank Digital Currency to Facilitate Financial Inclusion

Published

4 years agoon

#Jamaica, November 30, 2021 – Deputy Governor of the Bank of Jamaica (BOJ), Natalie Haynes, says Central Bank Digital Currency (CBDC) implementation is consistent with the Government’s overall financial inclusion strategy.

CBDC is a digital form of central bank-issued currency and, therefore, is legal tender that can be exchanged dollar for dollar with physical cash. Households and businesses will be able to use CBDC to, among other things, make payments as now obtains with cash.

“Financial inclusion is access by all to financial services and products [and] is a critical factor of Jamaica’s digital transformation. The Bank of Jamaica contributes to this by acting in its role as technical secretariat of the country’s national financial inclusion strategy,” Mrs. Haynes notes.

Through the CBDC, the BOJ will contribute to the financial inclusion process by enabling Jamaicans to seamlessly access financial products and services.

“CBDC is simply a digital form of money issued by a central authority. The Bank of International Settlements defines CBDC as a digital payment instrument denominated in the national unit account that is a direct liability of the central bank. In other words, the Central Bank is responsible for the CBDC that is issued,” Mrs. Haynes explains.

“With amendments to the Bank of Jamaica Act, CBDC will become legal tender. Legal tender means that all merchants, whether for goods or services, will confidently accept CBDC and know that they will get value for the good or the service that they provided,” she adds.

Mrs. Haynes points out that the CBDC should not confused with cryptocurrency.

“CBDC is not a cryptocurrency. A cryptocurrency is privately issued, and it’s not backed by a central authority. So, you have some of them out there [such as] Bitcoin, Ethereum and Ripple,” she informs.

The Deputy Governor tells JIS News that the central bank will be using the hybrid approach in introducing its CBDC.

“BOJ will not be issuing CBDC directly to retail customers. We are going to be issuing directly to deposit-taking institutions (DTI) that are licensed under the Banking Services Act; these are commercial banks, building societies, and merchant banks,” Mrs. Haynes outlines. She adds that in order to foster financial inclusion, “we will also issue to a group called payment service providers, that are currently operating and testing payment products in the bank’s FinTech regulatory sandbox”.

The BOJ will be issuing CBDC to payment service providers and DTIs who, in turn, will distribute it to their customers, clients, merchants and consumers through either an E-money wallet, card networks or other digital options for persons and entities to utilise in transactions.

“In this case, the BOJ issues to wallet providers (the collective name for DTIs and payment service providers) on a wholesale basis, just as we do with physical cash. When a bank wants physical cash, they place an order with BOJ and then they send their cash in transit courier to BOJ to collect the cash. In this case, they will still place their orders with BOJ, and we will issue them with the digital currency,” Mrs. Haynes explains.

The Deputy Governor is reassuring Jamaicans that the CBDC will add to the current pool of retail payment instruments in Jamaica, such as debit and credit cards, as well as prepaid cards offered by payment service providers.

“Think of it, basically, as cash that you have in your wallet. In this case, you’re going to have a digital purse or wallet. It is not e-money, which is a liability of e-money issuers, and, of course, because it is very much like cash, it does not earn interest. CBDC in Jamaica is going to be only for domestic use and will not be used for cross-border transaction,” Mrs. Hayes says.

She points out that one chief benefit of the CBDC is that there will be a more inclusive system for persons where every citizen will have a quick, safe and reliable digital retail payment instrument.

“It’s more efficient than cash. It is instantaneous, even for remote transaction, meaning you don’t have to be in front of the person. For cash, you have to be in front of the person to exchange cash. We can do person to person, person to business, and it goes both ways,” Mrs. Haynes adds.

She says the CBDC is also an incentive for persons who are apprehensive about the formal banking system to reap benefits if they plan to start a business.

“For example, you have a CBDC wallet with bank ‘A’ and then after a couple months of operating, your bank knows you and you can say ‘hey, I need a loan for my medium to small or microbusiness’; it gets you into the formal system. If your bank doesn’t know you and doesn’t know you exist, then it’s going to be very difficult to obtain those facilities,” Mrs. Haynes tells JIS News.

To access the CBDC, the Deputy BOJ Governor says customers will need to have a wallet, which is going to be different from your regular bank account.

“Of course, it’s going to be much easier and simpler to obtain with streamlined and simplified Know Your Customer (KYC) requirements,” Mrs. Haynes states. She also states that once an individual has a relationship with a bank, in that they already have a bank account with them, they can automatically get a CBDC account.

For those who are unbanked or do not have an account, then DTIs and authorised payment service providers will be able to onboard these individuals, who can then request a CBDC account.

To carry out CBDC transactions, consumers will be able to access, download and deploy a mobile wallet app on any mobile phone, tablet or similar device using the networks of both major telecoms service providers.

Customers will be able to top up their accounts with CBDC through all authorised agents or smart ABMs and do business using CBDC phone-to-phone with merchants.

“To get CBDC wallet, simply contact your wallet provider of choice. If you do not have a bank account, all you need when setting up your CBDC account is your name, Tax Registration Number (TRN), and government-issued photo ID (driver’s licence, passport or voter ID card),” Mrs. Haynes said.

When the CBDC is fully launched, all Jamaicans will be eligible for a CBDC wallet subject to the simplified KYC and the wallet providers’ risk assessment of the customer.

The BOJ is slated to commence national rollout of the CBDC platform during the first quarter of 2022.

It is anticipated that, by then, additional deposit-taking institutions (DTIs) will be onboarded to enable the issuing of wallets to facilitate an expansion of the number of individuals and businesses utilising the currency.

National Commercial Bank (NCB) is currently the sole DTI participating in the CBDC pilot, which commenced in June and is slated to conclude in December.

By: Lisa Rowe

Release: JIS

You may like

Caribbean News

Seven Days. Seven Nations. One Storm — Hurricane Melissa

Published

3 months agoon

November 1, 2025

A week of wind, water, and heartbreak

From Haiti’s hillsides to Bermuda’s reefs, seven Caribbean nations have been battered, bruised, and forever marked by Hurricane Melissa — a storm that tested not only the region’s infrastructure but its unshakable spirit of unity.

Saturday–Sunday, October 25–26 – The First Strike: Hispaniola

Before the storm even earned its name, torrential rain and flash floods swept across Haiti and the Dominican Republic, claiming lives and tearing through rural communities.

tearing through rural communities.

In southern Haiti, rivers burst their banks, swallowing roads and homes; 23 people were confirmed dead by Sunday evening. Across the border, one death was reported in the Dominican Republic as swollen rivers cut off villages in Barahona and Pedernales.

By nightfall, the tropical system had strengthened — and the Caribbean knew it was facing something historic.

Monday, October 27 – Evacuations and Airlifts

In The Bahamas, Prime Minister Philip Davis issued a mandatory evacuation for the MICAL Islands — Mayaguana, Inagua, Crooked Island, Acklins, Long Cay, and Ragged Island.

Bahamasair added extra flights as the nation braced for what forecasters warned could become the strongest storm in nearly two decades.

Meanwhile, Jamaica, Turks & Caicos, and Cuba activated their national emergency operations centers.

Tuesday, October 28 – Jamaica and Haiti Hit Hard

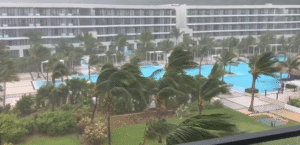

By afternoon, Hurricane Melissa made landfall near St Elizabeth, Jamaica, as a Category 5 hurricane — winds of 185 mph, central pressure 892 mb, the lowest ever recorded so close to the island.

Roads collapsed, bridges washed away, and Black River Hospital lost its roof. Power failed for 72 percent of the island.

BOJ TV footage shows split asphalt, sparking lines, and flooded communities abandoned for safety.

Initially four were reported dead, that grew to seven deaths and heavy damage in 170 communities; Andrew Holness, Jamaican Prime Minister calling it “a national test of resilience.”

Haiti, still recovering from the weekend’s flooding, was hit again as outer bands dumped more rain on Les Cayes and Jacmel, deepening the humanitarian crisis.

Wednesday, October 29 – Crossing to Cuba

Weakened slightly to Category 4 (145 mph), Melissa tracked north-northeast at 8 mph, hammering eastern Cuba with hurricane-force winds

and mudslides. Over 15 000 people were evacuated from Santiago de Cuba and Holguín.

In Turks & Caicos, the Regiment deployed to Grand Turk, Salt Cay, South, North and Middle Caicos, preparing shelters and securing public buildings.

Thursday, October 30 – The Bahamas and the All Clear

Melissa’s speed increased, sparing the northern Caribbean its worst.

The Bahamas Airport Authority closed 13 airports from Mayaguana to Exuma International; none reported casualties, though infrastructure suffered.

In Turks & Caicos, the all-clear came early Thursday after minimal impact. Premier Washington Misick expressed gratitude and pledged support for neighbors:

“We must act — not only with words, but with compassion and deeds.”

Friday, October 31 – Counting the Cost

By Friday, Melissa had weakened to Category 3 (120 mph) north of Cuba.

The Bahamas Department of Meteorology issued its final alert, lifting warnings for the southern islands.

Regional toll:

- Haiti: 23 dead, thousands displaced.

- Jamaica: 7 dead, 170 communities damaged; 72% without electricity

- Cuba: 2 dead, 15, 000 evacuated.

- Dominican Republic: 1 dead, flooding in southwest.

- Bahamas: 0 dead, minor infrastructure damage and flooding in southeast.

- Turks & Caicos: minimal to no impact.

Relief and Reconnection

The Cayman Islands became the first government to touch down in Jamaica post-storm. Premier Juliana O’Connor-Connolly led a contingent bringing a plane-load of essentials and pledged US $1.2 million in aid.

Reggae icon Shaggy arrived on a private jet with friends, delivering food, medical kits, and hygiene supplies.

Meanwhile, Starlink and FLOW Jamaica activated emergency satellite internet across Jamaica providing free connectivity through November.

From overseas, U.S. President Donald Trump, speaking during his Asia tour, announced that American search-and-rescue teams and disaster aid will support the region.

“They can depend on U.S. assistance as they recover from this historic storm,” he said.

Faith, Funds, and False Websites

The Government of Jamaica and the Sandals Foundation have both launched verified donation portals for recovery. Officials are warning against fake crowdfunding pages posing as relief sites and urging donors to use only official channels.

A Seventh Nation in the Crosshairs – Bermuda

As Hurricane Melissa left the Caribbean basin, Bermuda found itself next in line.

Forecasts indicated the storm would pass just west of the island late Thursday into Friday, likely as a Category 1 to 2 hurricane with sustained winds near 105 mph.

Though far weaker than when it ravaged Jamaica, officials issued a hurricane warning, urging residents to secure property and expect tropical-storm conditions.

By all appearances Bermuda is heeding the warnings

The Human Response

Across the Caribbean, solidarity surged.

The Global Empowerment Mission (GEM) in Miami began airlifting relief supplies, while churches, civic groups, and businesses in The Bahamas and Turks & Caicos organized drives for displaced families.

“Your dedication gave our islands the strength to face the storm,” Premier Misick said. “Together, as one Caribbean family, we will rise stronger.”

Resilience in the Wake

Melissa’s winds may have faded, but her impact endures. Engineers are inspecting bridges, hillsides, and water systems; volunteers are clearing debris and distributing aid in communities still cut off.

From Haiti’s ravaged river valleys to Jamaica’s sugar towns, from Cuba’s eastern hills to The Bahamas’ salt ponds and Bermuda’s reefs, the region once again stands at the crossroads of ruin and renewal — and leans, as always, toward hope and a faithful God

Caribbean News

Haitian Pushback Halts Controversial Constitution Rewrite — What’s Next?

Published

4 months agoon

October 15, 2025

Deandrea Hamilton | Editor

Haitian media, legal scholars and civic voices did what bullets and barricades couldn’t: they stopped a sweeping constitutional overhaul widely branded as anti-democratic. Editorials and analyses tore into proposals to abolish the Senate, scrap the prime minister, shift to one-round presidential elections, expand presidential power, and open high office to dual-nationals—a package critics said would hard-wire dominance into the executive at a moment of near-lawless insecurity.

The Venice Commission—Europe’s top constitutional advisory body—didn’t mince words either. In a formal opinion requested by Haiti’s provisional electoral authorities, it pressed for clear legal safeguards and credible conditions before any referendum, including measures to prevent gang interference in the electoral process—an implicit rebuke of pushing a foundational rewrite amid a security collapse.

Facing that drumbeat, Haiti’s Transitional Presidential Council has now formally ended the constitutional-reform initiative. The decision, taken at a Council of Ministers meeting at the National Palace, effectively aborts the rewrite track that has haunted Haiti since the Moïse and Henry eras.

So what now? Per the Miami Herald, the pivot is back to basics: security first, elections next. That means stabilizing Port-au-Prince enough to run a vote, rebuilding the electoral timetable, and empowering the provisional electoral machinery—none of which is simple when gangs control vast chunks of the capital and state authority remains fragile. Recent headlines underline the risk: gunfire has disrupted top-level government meetings, a visceral reminder that constitutional theory means little without territorial control.

Bottom line: Haitian journalists and public intellectuals helped slam the brakes on a high-stakes centralization of power that lacked legitimacy and safe conditions. International constitutional experts added weight, and the transition authorities finally conceded reality. Now the fight shifts to making an election possible—clean rolls, secure polling, and credible oversight—under circumstances that are still hostile to democracy. If the state can’t guarantee basic safety, any ballot is theater. If it can, shelving the rewrite may prove the first real step back toward consent of the governed.

Caribbean News

Political Theatre? Caribbean Parliamentarians Walk Out on House Speaker

Published

4 months agoon

October 14, 2025

By Deandrea Hamilton | Magnetic Media

October 14, 2025 – It’s being called political theatre — but for citizens, constitutional watchdogs, and democracy advocates across the Caribbean, it feels far more serious. Within a single week, two national parliaments — in Trinidad and Tobago and St. Kitts and Nevis — descended into turmoil as opposition members stormed out in protest, accusing their Speakers of bias, overreach, and abuse of parliamentary procedure.

For observers, the walkouts signal a deeper problem: erosion of trust in the very institutions meant to safeguard democracy. When Speakers are viewed as political enforcers instead of neutral referees, parliaments stop functioning as chambers of debate and start performing as stages for power and spectacle — with citizens left wondering who, if anyone, is still accountable.

October 6: St. Kitts Parliament Erupts

The first walkout erupted in Basseterre on October 6, 2025, when Dr. Timothy Harris, former Prime Minister and now Opposition Leader, led his team out of the St. Kitts and Nevis National Assembly in a protest that stunned the chamber.

led his team out of the St. Kitts and Nevis National Assembly in a protest that stunned the chamber.

The flashpoint came as the Speaker moved to approve more than three years’ worth of unratified parliamentary minutes in one sitting — covering 27 meetings and three national budgets — without individual review or debate.

Dr. Harris called the move “a flagrant breach of the Constitution and parliamentary tradition,” warning that the practice undermines transparency and accountability. “No serious parliament can go years without approving a single set of minutes,” he said after exiting the chamber.

The Speaker defended the decision as administrative housekeeping, but critics were unconvinced, branding the move a “world record disgrace.” The opposition’s walkout triggered renewed calls for the Speaker’s resignation and sparked a wider public discussion about record-keeping, accountability, and respect for parliamentary norms in St. Kitts and Nevis.

October 10: Trinidad Opposition Follows Suit

Four days later, on October 10, 2025, the Opposition United National Congress (UNC) in Trinidad and Tobago staged its own walkout from the House of Representatives in Port of Spain.

The UNC accused the Speaker of partisan bias, claiming she had repeatedly blocked urgent questions, ignored points of order, and allowed government members to breach standing orders without consequence.

“The Speaker has failed in her duty to act impartially,” the Opposition declared in a statement. “Parliament is not the property of any political party or Presiding Officer.”

The dramatic exit was seen as a culmination of months of rising tension and frustration, with opposition MPs arguing that parliamentary rules were being selectively applied to silence dissenting voices.

Political analyst Dr. Marcia Ferdinand described the twin walkouts as “a warning sign that parliamentary democracy in the Caribbean is teetering on the edge of performative politics.”

“When chairs become political shields rather than constitutional referees,” she said, “democracy becomes theatre, not governance.”

A Pattern Emerging

While St. Kitts and Trinidad are very different political environments, both incidents point to the same regional fault line: the perception that Speakers — the guardians of parliamentary order — are no longer impartial.

In Westminster-style systems like those across the Caribbean, the Speaker’s authority depends not on power but on public confidence in fairness. Once that credibility erodes, parliamentary control collapses into confrontation.

Governance experts say the implications are serious: eroded trust between government and opposition, declining public confidence in state institutions, and growing voter cynicism that “rules” are flexible tools of political advantage.

Why It Matters

Parliamentary walkouts are not new in the Caribbean, but what makes these recent events different is their frequency and intensity — and the regional echo they’ve created. Social media has amplified images of lawmakers storming out, with citizens from Barbados to Belize questioning whether the same erosion of decorum could be happening in their own legislatures.

the regional echo they’ve created. Social media has amplified images of lawmakers storming out, with citizens from Barbados to Belize questioning whether the same erosion of decorum could be happening in their own legislatures.

Analysts warn that if this perception takes hold, it risks diminishing the moral authority of parliamentary democracy itself.

“Once opposition MPs believe the rules are rigged, and once citizens believe Parliament is just performance,” said one Caribbean governance researcher, “you’ve lost the most valuable currency in democracy — trust.”

Restoring Balance

Political reformers across the region are calling for tighter Standing Order enforcement, independent parliamentary service commissions, and training to strengthen Speaker neutrality. Civil society leaders say the public must also play its part by demanding transparency and refusing to normalize partisan manipulation of parliamentary procedure.

Whether these twin walkouts become catalysts for reform — or simply another episode of Caribbean political theatre — will depend on what happens next inside those chambers.

For now, democracy watchers agree on one thing: when opposition leaders feel the only way to be heard is to walk out, the entire democratic house — not just its Speaker — is in danger of collapse.

Angle by Deandrea Hamilton. Built with ChatGPT (AI). Magnetic Media — CAPTURING LIFE.