TCI News

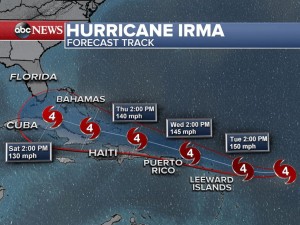

August 30th – One Year since Hurricane Irma named

-

Caribbean News7 days ago

Caribbean News7 days agoCayman Relief Mission to Hurricane hit CARICOM nations

-

Caribbean News7 days ago

Caribbean News7 days agoCARICOM raising profile and priority of its Migration Policy; curbing challenges ‘a tall order’

-

Caribbean News1 week ago

Caribbean News1 week agoHurricane Help; Money donated to Jamaica, Barbados, St Vincent & the Grenadines, St Lucia and Grenada

-

Caribbean News7 days ago

Caribbean News7 days agoJamaica’s Hurricane Recovery Efforts Bolstered by Donation from Cayman Islands

-

Bahamas News7 days ago

Bahamas News7 days agoPrime Minister Davis: Cannabis Reform Compendium 2024 ‘a long time coming’

-

News7 days ago

News7 days agoWhat the new UK Prime Minister had to say about the Rwanda Deportation Plan at his first press conference

-

Bahamas News1 week ago

Bahamas News1 week agoBahamas Celebrates 51st Independence – ‘United In Love & Service’

-

News7 days ago

News7 days agoTurks & Caicos’ E.J Saunders part of Election Observer team in UK on July 4