St. Thomas, U.S. Virgin Islands (USVI) –April 11, 2024—The U.S. Virgin Islands Department of Tourism, led by Commissioner Joseph Boschulte, Assistant Commissioner Alani Henneman, and Deputy Commissioner RoseAnne Farrington, traveled to Miami, Florida, to support Governor Albert Bryan Jr. and other local partners agencies for the 2024 Seatrade Cruise Global Conference.

To kick off the week-long event, the Department of Tourism sponsored the highly anticipated Florida-Caribbean Cruise Association (FCCA) barbecue, which was hosted by Governor Bryan.

Revered as a steady leader in the Caribbean tourism industry, the USVI delegation, which also included the Legislature of the Virgin Islands, the Virgin Islands Port Authority, West Indian Company Limited, Magens Bay Authority, and the U.S. Virgin Islands Government Employee Retirement System, showcased the territory and its growing accessibility around the cruise industry to key operators and businesses.

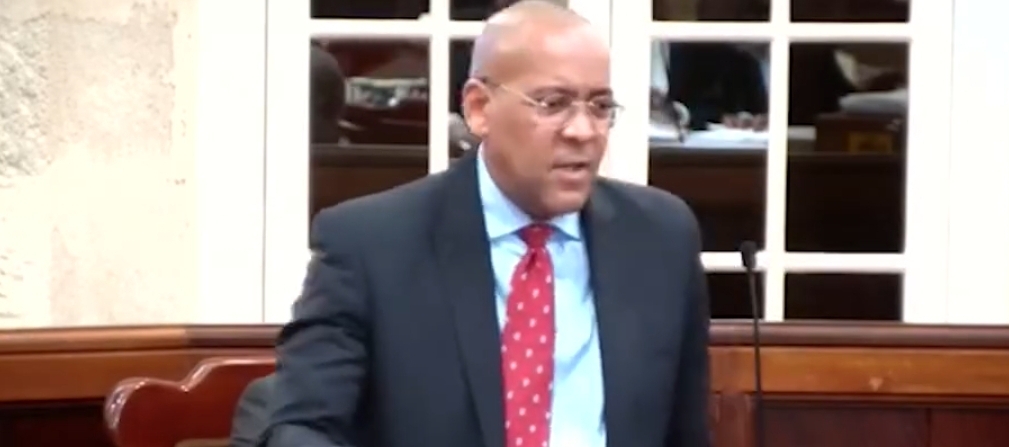

“Cruise has been and continues to be a leading entryway for visitors into the territory, and Seatrade allows representatives from the USVI to interface with and share pertinent updates needed to continue fostering positive relationships throughout the industry,” explains Commissioner Boschulte.

Commissioner Boschulte was featured on the Caribbean Spotlight panel moderated by renowned industry leader and FCCA CEO Michelle Paige, who referenced the Commissioner being named the 2023 Caribbean Tourism Executive of the Year by Caribbean Journal and shared how exceptional the publication’s acknowledgment of his accolades are. Paige referenced Caribbean Journal’s spotlight paragraph reading, “No Caribbean destination has seen more growth in the last three years than the U.S. Virgin Islands, which kicked off a full-fledged tourism renaissance just after the onset of the pandemic and hasn’t looked back. And so much of that growth can be directly tied to the expert stewardship of Boschulte, who helped craft an innovative, flexible response to the challenges of the pandemic and has continued to drive the USVI’s performance with a data-driven, creative approach to modern tourism.”

Commissioner Boschulte and Deputy Commissioner Farrington joined Governor Bryan for meetings with leading cruise lines, including Disney Cruise Line, Norwegian Cruise Line, and Carnival Corporation & plc, amongst others, to discuss continued partnerships, expansion opportunities, and industry updates.

As the global cruise industry continues to restabilize following challenges incurred during the COVID-19 pandemic, St. Thomas and St. Croix experienced a 13% growth in 2023 over 2019, with West Indian Company Dock, Crown Bay Dock, and E. Abramson Marine Facility welcoming more than 1,600,000 passengers from 495 total calls for the year. With a 58% year-over-year passenger increase from 2022 to 2023, the USVI continues to grow and is projected to experience another 5% increase in cruise passenger arrivals in 2024.

Commissioner Boschulte also highlighted the remarkable success of the USVI and Caribbean region, stating, “I am proud to see the Caribbean’s appeal continue to captivate travelers. Our collaborative efforts with partners like FCCA and the Caribbean Tourism Organization underscore the unity of our region, ensuring unforgettable experiences for visitors while highlighting the unique strengths of the U.S. Virgin Islands. With a safe, welcoming destination and a shared commitment to tourism, we embrace our role as an integral part of the Caribbean community.”

News5 days ago

News5 days ago

Health5 days ago

Health5 days ago

TCI News1 day ago

TCI News1 day ago

Caribbean News7 days ago

Caribbean News7 days ago

Caribbean News1 week ago

Caribbean News1 week ago

Caribbean News4 days ago

Caribbean News4 days ago

Education4 days ago

Education4 days ago

Bahamas News1 week ago

Bahamas News1 week ago